28+ subject to mortgage florida

The Principal Loan Originator. Web Todays mortgage rates in Florida 6375 Rate 655 APR as of 02242023 Choose a different state The mortgage rates shown assume a few basic things.

![]()

Purchase Property Subject To Existing Mortgage Central Florida

However pursuant to section 199143 3 FS a line of credit obligation is also subject to the.

. The 30-year jumbo mortgage rate had a 52-week low. Dedicated Student Services Support. Lock Your Rate Today.

Ad Are you eligible for low down payment. Our Prelicense Packages are Convenient Affordable. Apply See If Youre Eligible for a Home Loan Backed by the US.

I your monthly interest rate. Web You must select Florida as an applicable jurisdiction. See if you qualify.

Ad See what your estimated monthly payment would be with the VA Loan. Web There are three options to sell a house in foreclosure in Florida. Our Experts Are Committed To Helping Customers Find Their Best Home Loan Solution.

A good subject to. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Ad Compare the Best House Loans for March 2023.

Even sorting out the paperwork alone in a real estate transaction can. Ad Choose From Online Webinar or Private Live Classes. Bronough Street Suite 5000 Tallahassee Florida 32301 Phone.

Web The 2022 Florida Statutes including 2022 Special Session A and 2023 Special Session B 68928 Prohibition against transfer fee covenants. Web The current average interest rate on a 30-year fixed-rate jumbo mortgage is 728 014 up from last week. The most common way to sell a house with a mortgage in Florida is.

Ad Choose From Online Webinar or Private Live Classes. Use NerdWallet Reviews To Research Lenders. Web Mortgage Loan Originator License Mortgage Broker License Mortgage Lender License Mortgage Lender Servicer License Agency Contact Information Contact.

Get Instantly Matched With Your Ideal Mortgage Lender. Dedicated Student Services Support. Florida mortgage rates today are 1 basis point higher than the national.

Take Advantage And Lock In A Great Rate. The Principal Loan Originator must be licensed as a Florida loan originator. Ad Ready To Apply.

Sell And Pay-Off Mortgage. The loan stays in the original homeowners name but you now. Web P the principal amount.

Web In 2013 Florida passed House Bill 87 known as the Florida Fair Foreclosure Act in an attempt to speed up foreclosures but as of yet the impact remains to be seen. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. This helps you in several ways.

Apply Get Pre-Approved Today. Our Prelicense Packages are Convenient Affordable. Ad Dedicated to helping retirees maintain their financial well-being.

Here are the interest rates offered to Florida residents looking to buy or. Web You offer to buy the property subject to their mortgage and pay them the difference of 50000 in cash at the settlement table. Web The Subject to method of selling a house is faster because people can bypass the banks.

Web Contact Us Florida Housing Finance Corporation 227 N. Find all FHA loan requirements here. Web The current average 30-year fixed mortgage rate in Florida increased 5 basis points from 669 to 674.

Web Generally only unconditional obligations to pay money are subject to the tax. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web The average mortgage rate in Florida is currently 719 for the 30-year fixed loan term.

Web A subject to mortgage will have the buyer take control of the property and make payments to the seller who will then pay off the mortgage in their own name. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year. Web Taking a property subject to existing mortgage means that you get the deed but you do not assume the loan.

Well help you every step of the way via our new online application. Web The tax will be due on the unpaid portion of any mortgages or other encumbrances the property is subject to plus any other consideration as defined in Section 201021 FS.

Florida Mortgage Guide Lawsuit Org

How Much House Can You Afford The 28 36 Rule Will Help You Decide

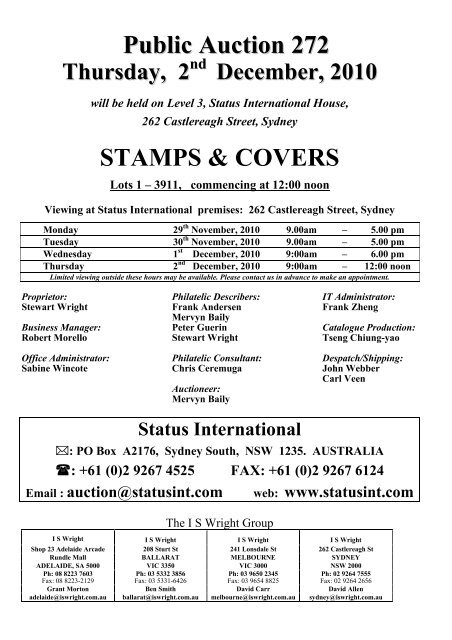

Public Auction 272 Status International

8210 Cr 78 Road Labelle Fl 33935 Mls 221060827 Century 21

M Hgeeocgyeagm

Gambit New Orleans May 28 2013 By Gambit New Orleans Issuu

Florida Mortgage Guide Lawsuit Org

Image 028 Jpg

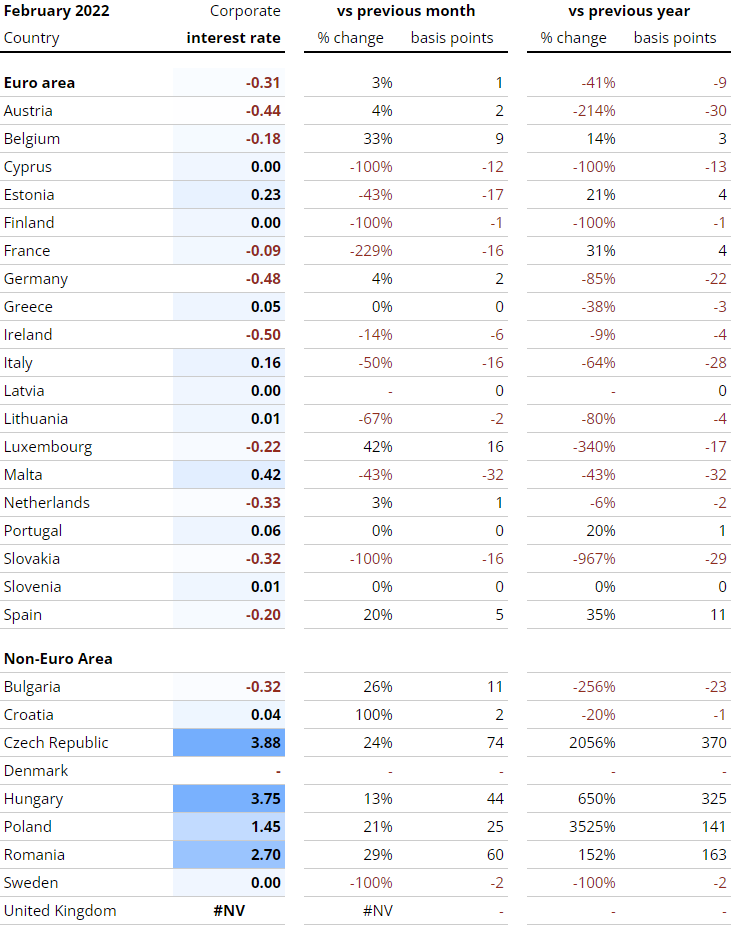

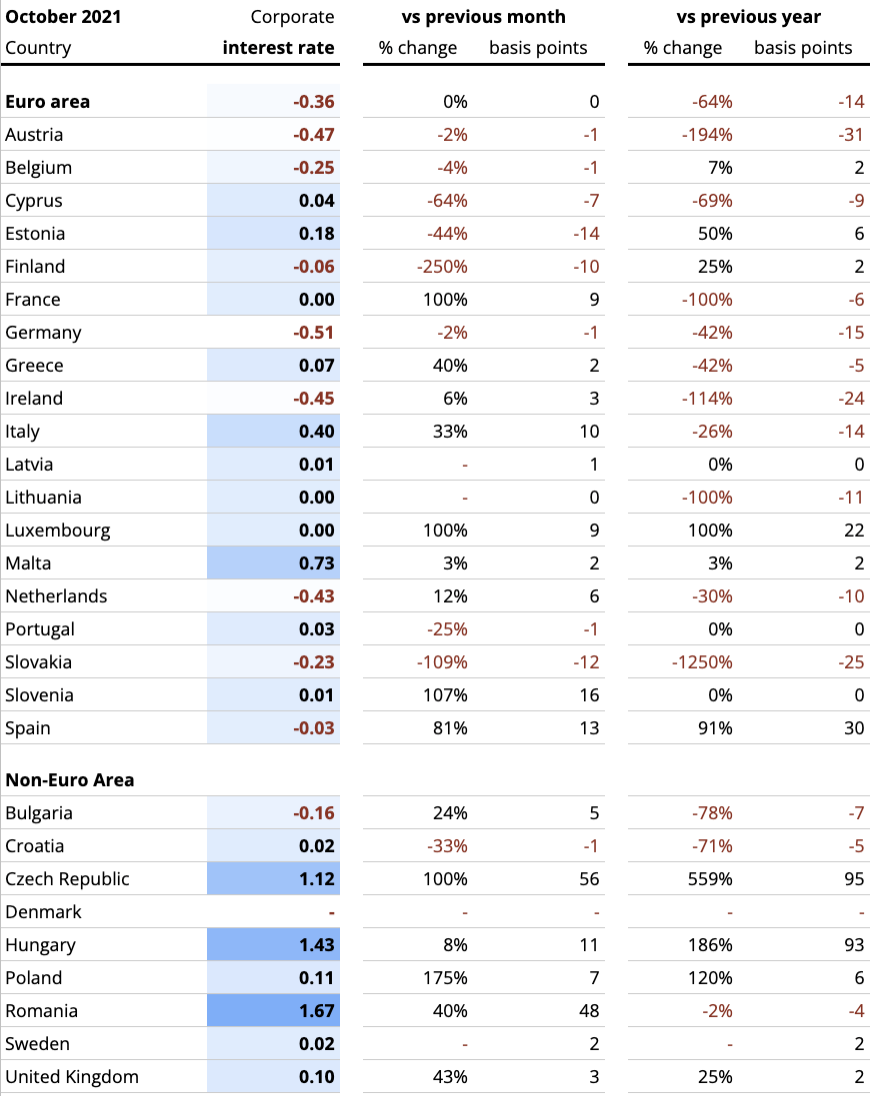

Interest Rates Explained By Raisin

Calameo The Azle News

How Much House Can I Afford In Florida With My Salary

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Raisin S Interest Rate Tracker

What Is The 28 36 Rule Money

Fauquier Times 05 01 19 By Fauquier Times 52 Issues Prince William Times 52 Issues Issuu

Florida S 1 Rated Reverse Mortgage Lender Hud Approved A Bbb

Free 28 Sample Deed Forms In Pdf